How Leaving Money To Charity Can Also Cut Your Inheritance Tax Bill

Last updated on December 10th, 2018 at 11:47 am

Making a will is the only way to decide who benefits from your estate — which is made up of assets such as property, money and possession — after your death. Of course, making sure your family is looked after financially is an important consideration. However, there are benefits to leaving money to charity too: not only are you supporting a social good but it also has positive tax implications.

The wills and probate experts at Graysons Solicitors talked to three prominent Sheffield charities — Bluebell Wood Children’s Hospice, Sheffield Royal Society for the Blind (SRSB) and Support Dogs — about the important work they do and their reliance of charitable will donations.

The following sections have been devised to guide you through leaving money to charity in a will. Click on the links below to jump to the relevant section:

Why make a will?

Without a valid will, your estate will be distributed according to the rules of intestacy, which would see proportions going to your spouse or civil partner, with the rest shared out to the next relative in the order specified by the intestacy rules. This means if you die without a valid will (known as ‘intestate’) there is no provision for unmarried partners or friends to benefit from your estate.

Find out more about wills here:

How charitable will bequests can reduce your inheritance tax burden

If you fail to make a will your estate will be distributed according to intestacy rules. There are several problems that can arise from this situation, namely:

- You miss an opportunity to leave assets to other people or organisations (such as charities) that are important to you.

- Your family may be burdened with an inheritance tax bill to pay, if your estate is not set up to minimise this.

The benefits

Making a will and using it to leave money to charity doesn’t have to be just about that warm feeling that comes with largess: it can help both charitable organisations and your beneficiaries. As well as helping charities to provide vital support and services, a charitable bequest can reduce the value of an estate so it falls under the ‘nil rate band’ exemption for inheritance tax (currently £325,000 per person plus £100,000 RNRB) — meaning no tax would be payable.

Additionally, if you leave 10% of your ‘net estate’ (what is left after the nil rate band, RNRB and any debts or liabilities have been applied), it can reduce the rate of IHT payable from 40% to 36% on any amount above the nil rate band.

By taking advantage of this tax break, you will be able to donate to a worthy cause and be rewarded by paying less inheritance tax than you would otherwise have done.

How does it work?

Legacies bequeathed in wills are deducted from an estate during the initial stages, at the same time as debts, tax and the expenses of administration. The money left after this is known as the ‘residue of your estate’.

Here is an example: Assuming there is no RNRB, if you leave an estate valued at £350,000 (after any liabilities and debts have been deducted), inheritance tax is payable at 40% on £25,000 of that — the amount above the nil rate band of £325,000.

- However, if you left £25,000 to charity, the figure would reduce to £325,000 and no inheritance tax would be due.

Here is another example: if you leave an estate valued at £500,000 (again, assuming no RNRB but after any liabilities and debts have been deducted), normally inheritance tax would be due at 40% on the £175,000 (£500,000 – £325,000 = £175,000). That means you’d have to pay £70,000 in inheritance tax.

- However, if you left 10% of that estate (which would be £50,000) to charity, then the value would reduce to £450,000, and inheritance tax would be due on the £125,000 above the nil rate band, but at a reduced rate of 36%. This means that you’d have to pay £45,000 inheritance tax.

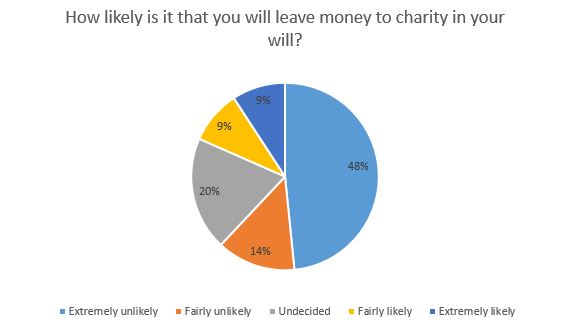

Levels of charity donations in Yorkshire: Our own research

We surveyed 1,000 people aged 18-65+ in Yorkshire and the Humber, asking them how likely it is that they will leave money to charity in their will.

The overall results are as follows:

Overall result

As we can see, the majority of people we surveyed in Yorkshire are extremely unlikely to leave charities any money in their will. This is bad news for such organisations, and wider society; the work that charities do make a positive and tangible difference to the lives of everyone living both in the UK and around the world. Without adequate funding, their ability to affect change and provide much-needed support will be greatly diminished.

Why don’t people consider charities in their will?

Many people in the UK are simply unaware of the financial benefits that can be gained from leaving a legacy gift to charity. Though this tax provision has be publicised by the Government, the message has yet to fully reach all those in a position to consider the option.

Further reasons include:

- Some people may think that they will never make a will, so leaving money to charity simply doesn’t occur to them.

- The current squeeze on housing means younger generations feel they will never have any spare money.

Sheffield charities and the importance of will legacies

As you can see from the survey results, charities face an uphill struggle when receiving funding from wills. Despite this, a number of prominent Sheffield charities rely heavily on will bequests for their income.

We asked three charities — Bluebell Wood Children’s Hospice, Sheffield Royal Society for the Blind (SRSB) and Support Dogs — about their experience of legacy donations. Here is what we found:

|

Name of charity |

Legacy amount received each year |

% of overall yearly income |

|||||

|

2014 |

2015 |

2016 |

2014 |

2015 |

2016 |

||

|

Bluebell Wood |

£555,000 |

£426,000 |

*£1.4m |

14 |

13 |

27 |

|

|

SRSB |

£42,046 |

£171,292 |

£163,837 |

3 |

12 |

11 |

|

|

Support Dogs |

£156,000 |

£182,000 |

£200,000 |

35 |

25 |

24 |

|

The data shows that legacies contribute a small but significant amount to the income of these charities. Talking with the charities, we heard about some of the vital work this money helps to provide.

Bluebell Wood Children’s Hospice offers vital care and support to children with a shortened life expectancy and complex medical needs. This includes aiding families in their own homes and providing support at the charity’s dedicated hospice.

Bluebell’s Julie Booth reiterates how important legacies as a source of income are, and expresses her gratitude to those people who kindly leave the charity a gift in their will. She gives the example of Allen Fiddament from Goldthorpe, who in 2016 kindly left the hospice £30,000 in his will. Julie goes on to explain how this money could be used to fund 60 days of specialised nursing care for the children staying at the hospice.

“By leaving a gift to our hospice in your will, you can give our children and their families the chance to be supported at the most difficult of times,” she said.

“We would love to invite anyone who is considering leaving a legacy to the hospice so that they can see for themselves what a difference they can make.”

Sheffield Royal Society for the Blind has been supporting people with sight loss in Sheffield for over 155 years.

SRSB fundraiser Sue Coggin says that legacies are fundamental to their annual income.

“In some cases, [legacies] fund capital investment to enable us to deliver a wider reach of services, and in some years they subsidise our annual operating costs.”

One example of the crucial work that legacies fund is the Mobile Information Unit (MIU), which is sent around the streets to promote eye health. The aim of the MIU is to both publicise eye services in the city and also reduce the need for such services in the future by improving general eye health.

Support Dogs trains specialist assistance dogs and supplies them free of charge to increase independence and quality of life for people with certain medical conditions.

Here are some of the costs that legacies can pay for to provide training and on-going support for dog partnerships:

|

£10 |

The cost per day of one working assistance dog |

|

£25 |

Buys leads, collars and identity disks |

|

£50 |

Buys jackets and specialised harnesses |

|

£100 |

Covers the cost of advanced training for a client/dog partnership |

|

£500 |

Covers the cost of a client/dog assessment |

|

£1,000 |

Covers the cost of a client’s expenses during the residential training period |

|

£2000 |

The cost per year of providing on-going support to a working support dog |

|

£8,000 |

Cover the costs of caring for and socialising a puppy during its first year |

Danny Anderson, from Support Dogs, said: “The wonderful thing about leaving a donation to Support Dogs in your will is that it will genuinely bring a lifetime of difference to an individual and their family. It will leave a legacy that will be felt by many for years to come.”

The Graysons step-by-step guide to leaving charitable provision:

It’s actually surprisingly easy to leave a will legacy to charity, providing you have the right legal advice:

|

Step 1: Decide who will write your will

|

It’s best to have your will drafted by a solicitor to ensure it is worded in the correct way, especially detailing either the amounts or proportions you want to leave to any charities.

Having your will written by a solicitor specialising in probate will ensure that it is completely clear and legally unambiguous. This cuts down on bureaucracy and confusion when administering your estate, as well as the chance of your will being challenged by any disgruntled relatives. |

|

Step 2: Choose your executors

|

You can name executors in your will who can carry out the wishes of your will and administer your estate after your death. Your executors may need to obtain probate. Graysons’ solicitors can help the executors as much or as little as you would like, from just obtaining the grant of probate, to full administration of the estate — including passing assets to the beneficiaries of the will. This will include the money you have bequeathed to charity. |

|

Step 3: Calculate how much you want to leave |

First you need to decide how much of your estate you wish to leave. If you wish the money to be taken out only after provision has been made for relatives and friends, you’ll have to include a simple clause stating as much. However, you will only enjoy the full tax benefits by leaving to charity a fixed amount that is 10% of your estate’s value. |

|

Step 4: Choose a charity or charities |

Only certain charities will entitle you to inheritance tax reductions. Check to see which ones these are. |

|

Step 5: Arrange to make your will |

Once the will has been drafted it will need to be signed by yourself and two witnesses (non beneficiaries). Finally, tell those you have named as executors where the will has been stored so they are able to carry out your wishes, such as honouring any gifts to charity you have made. |

Updating your will

It’s useful to regularly review your will at least every five years or following major life events such as marriage, divorce or the arrival of children (either by birth or adoption).

If you want to add a charity to your existing will, there are two ways you can change your will:

- You can add a codicil if it is a minor and straightforward change.

- You should write a new will if there are complex changes.

In any case, any changes to your will should be signed by you and witnessed, and a clause made that assures your new will revokes any previous wills or amendment. If you write a completely new will you’ll need to securely destroy the previous one.

Also, it’s definitely worthwhile explaining in your will why you want to leave the money to charity, perhaps by detailing the charity’s significance to you. This can be particularly helpful if you want to purposefully disinherit one of your family members.

For more information about wills, legacies or any other topic mentioned on this page, ring 0114 272 9184 (Sheffield) or 01246 229 393 (Chesterfield) and talk to one of our experience team members.